Liquid Gold: Buying The Best Wine At Auction

Firms like Berry Bros. & Rudd and Hedonism Wines are queuing up to sell you luxury labels – so why bother going to an auction?

The answer is choice: you’ll find scores of older, rarer wines at auction that most retailers probably won’t stock, and auction prices are generally lower than retail prices.

“We have bought a small number of parcels from auction for The Vineyard Hotel, but only ever from the reputable auction houses like Christie’s and Sotheby’s,” says James Hocking, owner of The Vineyard Cellars. “It can sometimes be the only way for us to access mature wine not otherwise available on the market, so in that sense they are an extremely valuable source of special wines.”

Moreover, with fine wine still proving a good long-term and dependable equity investment, there’s still the opportunity to make a decent profit.

However, the maxim ‘caveat emptor’ has a particular relevance in the wine trade – buying at auction is fraught with potential pitfalls, and expensive disappointments are by no means unknown.

For a start, buyers need to remember that the hammer price isn’t the final price they will be paying; there will be a commission price of approximately 20 per cent on top of that, and if the wines are being sold ‘in bond’, there will also be duty and VAT to be paid. Remember to read the catalogue very carefully to check whether wines are in bond or duty paid, otherwise a lot you have purchased could easily double in price.

Leading sommelier Clement Robert MS also advises buyers to “pay attention to the provenance of stock before bidding.” If a wine has been stored on the other side of the world, for example, there is a chance that bottles have suffered from transportation, especially if you are purchasing mature wines.

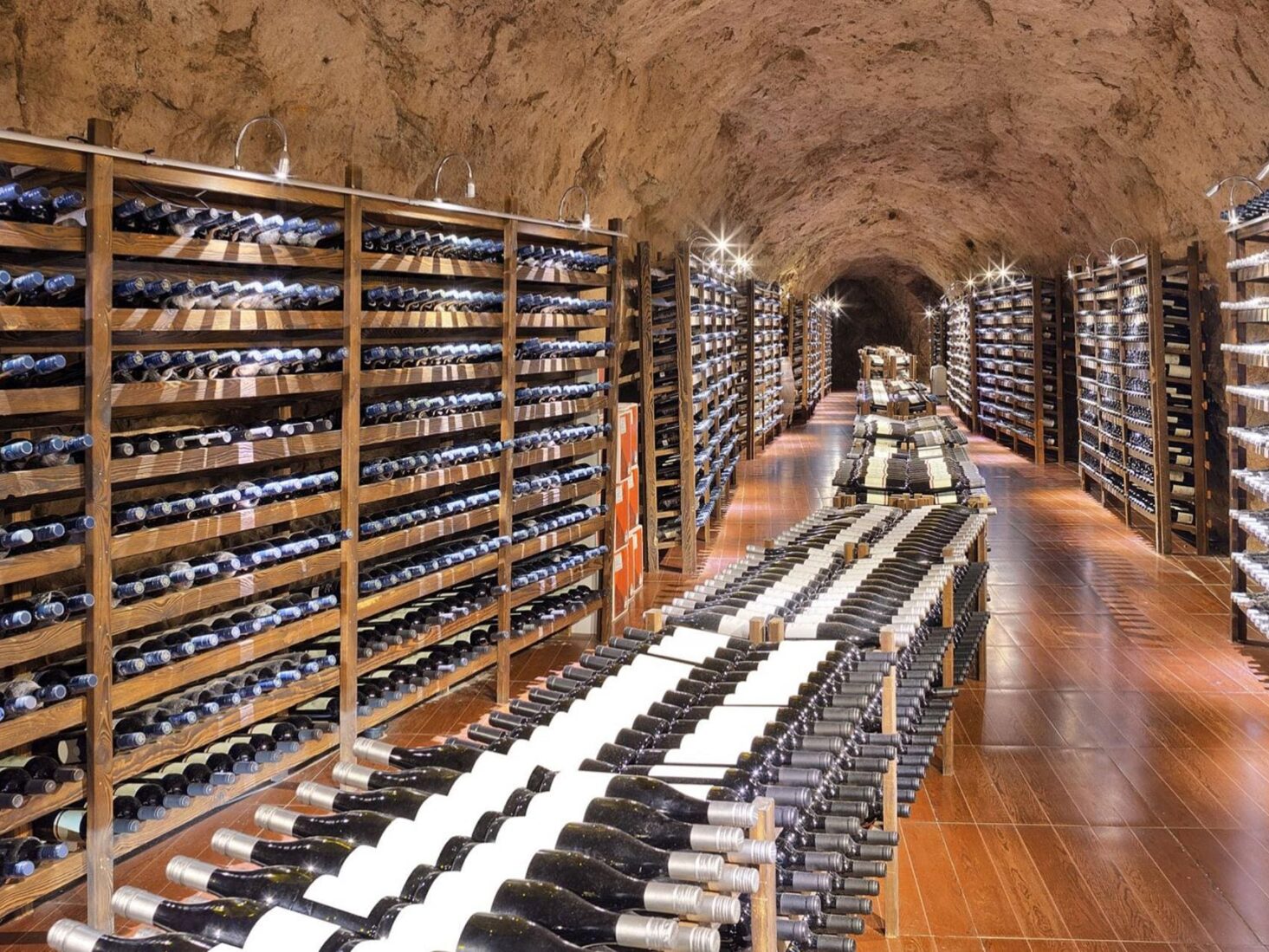

“Storage can be a big issue with auction wines. The catalogue should say where the wine is stored – hopefully at a reputable, professional cellar, such as Octavian,” adds Hocking.

Hocking also notes that any reputable catalogue will show pictures of the cellar if the wine is from a private collection, and offer a detailed description. “This is critical,” he says. “If the wine has moved around a bit, that is also a warning sign. There is always an element of risk once the wines are out of the hands of the winery and the merchant.”

Hocking also underlines the point that buyers should, if possible, examine the bottles at the pre-sale viewing – dust on top of the bottle means they have been stored upright and will be in less good condition than their horizontally stored counterparts. Levels of wine should be checked too. If they are low, just don’t touch it.

Ultimately, though, the key thing for you to consider during the auction process is whether you are buying for pleasure or investment. Purchasing wines destined for the dinner table gives you more options and freedom; you don’t have to limit yourself to the most famous names – Cheval Blanc, Lafite, Mouton Rothschild, etc – and you can explore equally memorable, but cheaper Bordeaux wines.

In addition, professional wine dealers and restaurateurs typically ignore bottles with torn or stained labels, as they are difficult to re-sell. But for the buyer who simply wants to enjoy their purchases, some real bargains can be obtained as the bidding will often be lacklustre. Also, investors often want to buy bottles of the same wine from one vintage – mixed lots containing different vintages or wines are always less attractive to investors and therefore better value.

However, if your sole motivation is to make a return on your investment, you’ll need to limit yourself to a narrow spectrum of fine wines – Bordeaux and Burgundy being the usual suspects. When bidding for older vintages, it is advisable to try and stick to single cellar collections that have been properly stored and cared for. These will always command a premium from future buyers, and it’s a good idea to research a wine collection’s provenance. Lastly, always cross-reference the wine’s retail value prior to bidding, several online wine search engines will calculate a wine’s value for you.

But most importantly, always exercise caution when buying older wines. Faking of old vintages, especially Bordeaux wines, is becoming increasingly common and at auction you are buying ‘as-is’, so read the fine print in the catalogue regarding warranties and your rights.

Alarm bells should start ringing if it looks like all aspects of the bottle – cork, capsule, label and glass – were not aged together. After, say, 25 years, there should be some oxidation of the label and capsule and the cork will not look youthful after spending over two decades in a dusty cellar. Also, give particular attention to the ullage levels – the air space between the cork and the liquid – as older bottles should have a bigger space between the cork and wine.

Finally, as with any auction, always keep a cool head, set a ceiling for your maximum bid and stick to it. It’s easy to fall foul of auction fever and end up spending far more than you anticipated. Few wines qualify as one of a kind and the wines you are after will undoubtedly re-appear at future auctions.

Or, as James Hocking so eloquently describes it: “Whilst it can be extremely worthwhile buying wine at auction, there is always an element of risk. It comes down to a balance of price, quality of storage and rarity. You may well pick up a bargain but do remember if your DRC is corked, there is no come back.”